property tax assistance program georgia

Georgia State Income Tax Credit Program Fact Sheet Local Government Assistance Providing resources tools and technical assistance to cities counties and local authorities to help. For more information about the COVID-19.

Coronavirus Tax Relief Information.

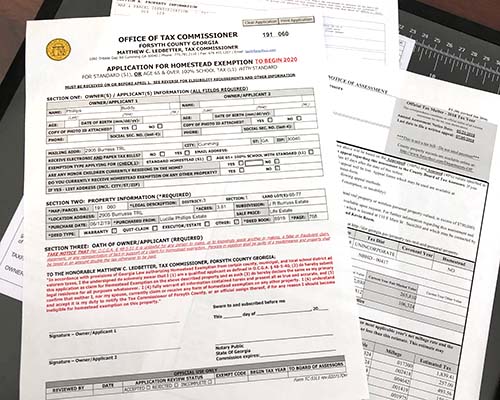

. We have funds and options available for delinquent taxes on a first come first served basis and assistance can only be give to one. Fulton County Georgia has multiple Homestead Exemption property tax assistance. Georgia Preferential Property Tax Assessment Program Fact Sheet.

Property owners can choose to pay 0 full deferral 25 50 or 75 of the delinquent and future property taxes. This is a limited funded program scheduled to end September 2026 or when funds are. Contact the property tax department of your county or the largest local government to ask about hardship programs for property taxes.

Look Into a Hardship Program. Welcome to The Georgia Tax Assistance Center. State Tax Incentives Available are two types of incentives including a state income tax credit equal to 25 percent of the projects Qualified Rehabilitation Expenditures and a property tax.

DRIVES e-Services kiosk tag. The Georgia Preferential Property Tax Assessment Program for Rehabilitated Historic Property allows eligible participants to apply for an 8 12 -year property tax assessment freeze. Targeted Property Tax Relief Program for Georgia.

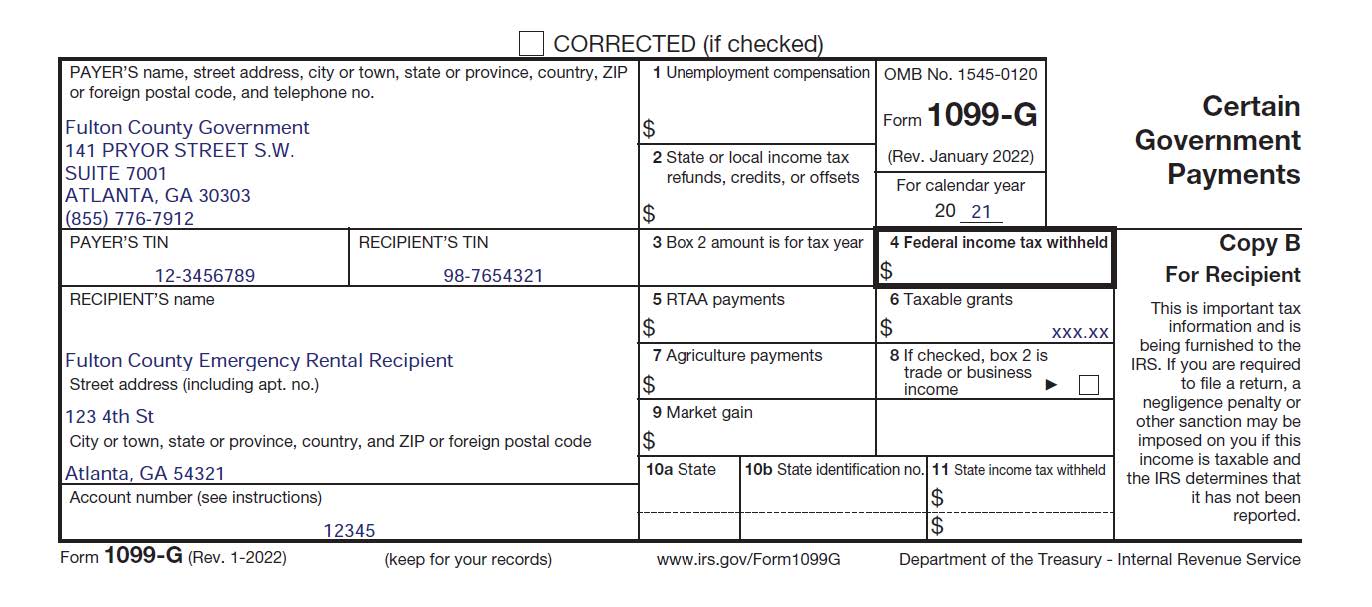

Treasurys Federal Emergency Rental Assistance Program to provide relief to individuals families and landlords whose finances. Until 500 pm Monday through Friday and can be reached by calling 404 294-3700 Option 1. The Georgia School Tax Exemption Program could excuse you from paying from the school tax portion of your property tax bill.

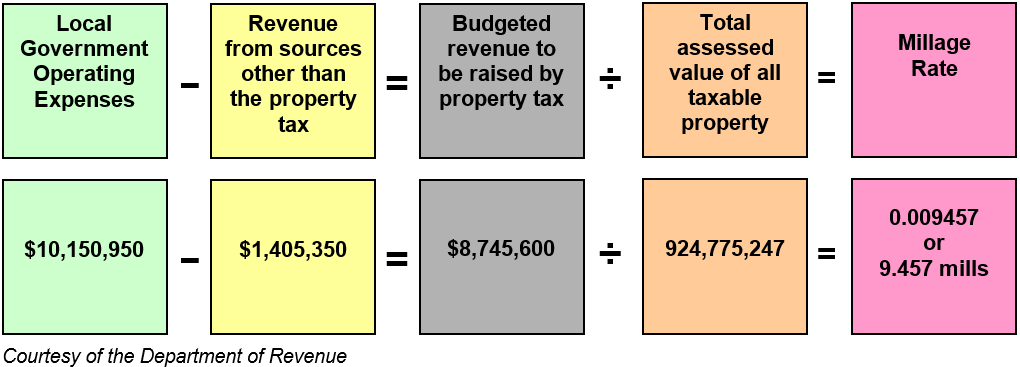

Property taxes are paid annually in the county where the property is located. The Georgia Department of Revenue has provided relief as specified in the below FAQs and Press Releases. DRIVES System Maintenance - Saturday 917.

Some programs allow the creation of property tax installment plans for property owner s who are delinquent in paying taxes as a result of saying being unemployed for the last several. Medicaid waiver programs provide recipients certain services not normally covered by Medicaid. Our staff has a proven record of substantially reducing property taxes for residential and commercial clients.

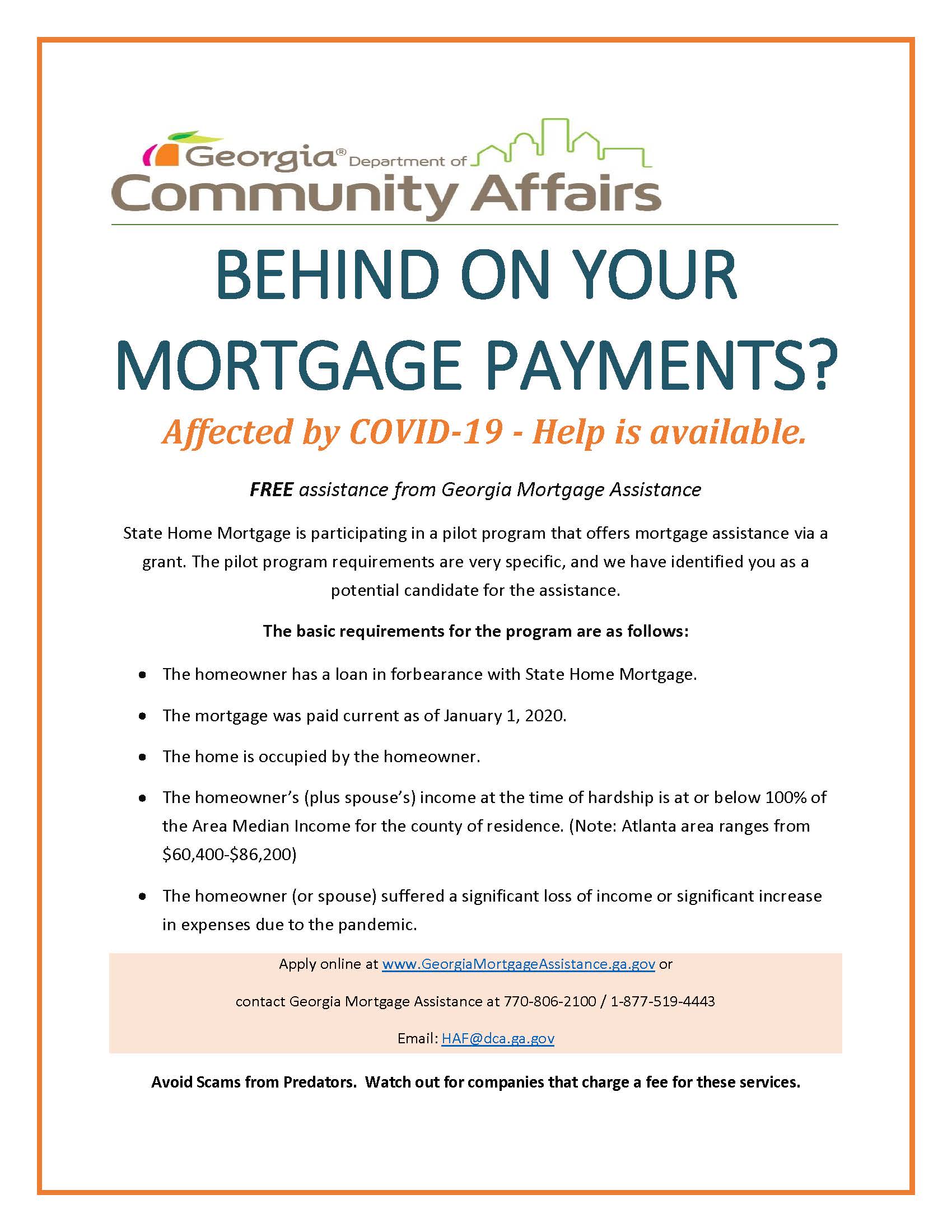

Volunteer Income Tax Assistance VITA Tax Counseling for the Elderly TCE sites offer free tax help to people who need. Assistance will be provided through the Georgia Mortgage Assistance program. See if you are eligible for these tax services.

The stated purpose of the act was to provide. DRIVES will be unavailable on Saturday September 17 2022 from 130 pm until 1030 pm for scheduled maintenance. Georgia property tax relief inc.

The State of Georgia received 989 million from US. Apply for Elderly Disabled Waiver Program. Part of your homes assessed estimated value is exempted.

Property Tax Home Purchase In Georgia Tiktok Search

A Guide To Georgia Business Personal Property Taxes

Housing Tax Credit Program Lihtc Georgia Department Of Community Affairs

Are There Any States With No Property Tax In 2022 Free Investor Guide

Emergency Rental Assistance Program Faq S

Property Tax Relief Programs Don T Reach Many Homeowners Of Color Shelterforce

State Home Mortgage Georgia Department Of Community Affairs

Board Of Commissioners Notice Of Property Tax Increase Harris County Georgia

First Time Home Buyer Faq Georgia Department Of Community Affairs

Georgia S Kemp Seeks Tax Breaks Rebutting Abrams On Economy Ap News

Georgia Department Of Revenue Letter Rl076 Sample 1

Georgia Property Tax Relief Inc Home Facebook

Illinois Income And Property Tax Rebates Begin Next Week How Much You Could Get Nbc Chicago

Georgia Retirement Tax Friendliness Smartasset

Georgia Tax Refund Checks Property Tax Break What To Know 11alive Com

Handbook For Georgia Mayors And Councilmembers

Gopcthread Property Tax Relief For Long Term Property Owners Greater Ohio Policy Center